prince william county real estate tax due dates 2021

Business personal property filing deadline. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of.

How Healthy Is Prince William County Virginia Us News Healthiest Communities

To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to.

. The due date for 2nd half 2021 real estate taxes is december 6 2021. 17 2020 the Prince William Board of County Supervisors passed a resolution extending the payment deadline for real estate taxes for the second half of 2020 for 60 days. Every taxpayers levy.

The due date for 2nd half 2021 real estate taxes is december 6 2021. Personal Property Taxes and Vehicle License Fees Due. Report a Change of Address.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living. Prince william county real estate tax due dates Wednesday July 6 2022 Edit. The second half are due by December 5 2022.

Prince William County real estate taxes for the first half of 2021 are due on July 15 2021. On or before June 30 2022. State Estimated Taxes Due Voucher 1 June 5.

Ad Scan Real County Property Records for the Real Estate Info You Need. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Prince william county real estate tax due dates 2021.

Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. A collection fee of 30 is added to accounts for more than 30 days delinquent. To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021.

July 17 2021. Then they multiply that by the tax rate to get your property tax. The deadline has been changed from Dec.

Second-half Real Estate Taxes Due. Personal Property Taxes Due. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

State Income Tax Filing Deadline. Click here to register for an account or here to login if you already have an account. Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News.

See todays top stories. Hours of operation for in-person and telephone taxpayer. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct.

Provided by Prince William County Communications Office Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703-792-6710 or by email at email protected. You can pay a bill without logging in using this screen.

A convenience fee is added to payments by credit or debit card. Who do I contact to get one in Virginia County Prince William. 5 2020 to Feb.

How will i recieve my pets license and annual renewal notice. Business License Renewals Due. The 2022 first half real estate taxes were due July 15 2022.

Prince William County property taxes for the first half of 2022 are due July 15 2022. First Pageland Lane Data Center Plan 7 900 000 Square Feet Headlines Insidenova Com. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Prince william county real estate tax due dates. Find Information On Any Prince William County Property. Prince William County Real Estate Taxes Due July 15 2022.

Learn all about Prince William County real estate tax. All you need is your tax account number and your checkbook or credit card. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. Payment by e-check is a free service. By creating an account you will have access to balance and account information notifications etc.

The extension applies to both commercial and residential real property. Monday May 30 2022. During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes due on July 15 2020 until Oct.

Other public information available at the real estate assessments office includes sale prices and dates legal descriptions. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. You will need to create an account or login.

Provided by Prince William County Communications Office. Prince William County Real Estate Assessor. Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements.

The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105. Please contact Taxpayer Services at 703-792-6710 M-F 8 AM 5 PM. With due diligence examine your tax levy for all other possible errors.

FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. I havent received my property tax bill yet. By mail to po box 1600 merrifield va 22116.

During a meeting on Nov. Report changes for individual accounts. If the real.

Hi the county assesses a land value and an improvements value to get a total value. How property tax calculated in pwc. Make a Quick Payment.

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Headlines Insidenova Com

2022 Best Places To Buy A House In Prince William County Va Niche

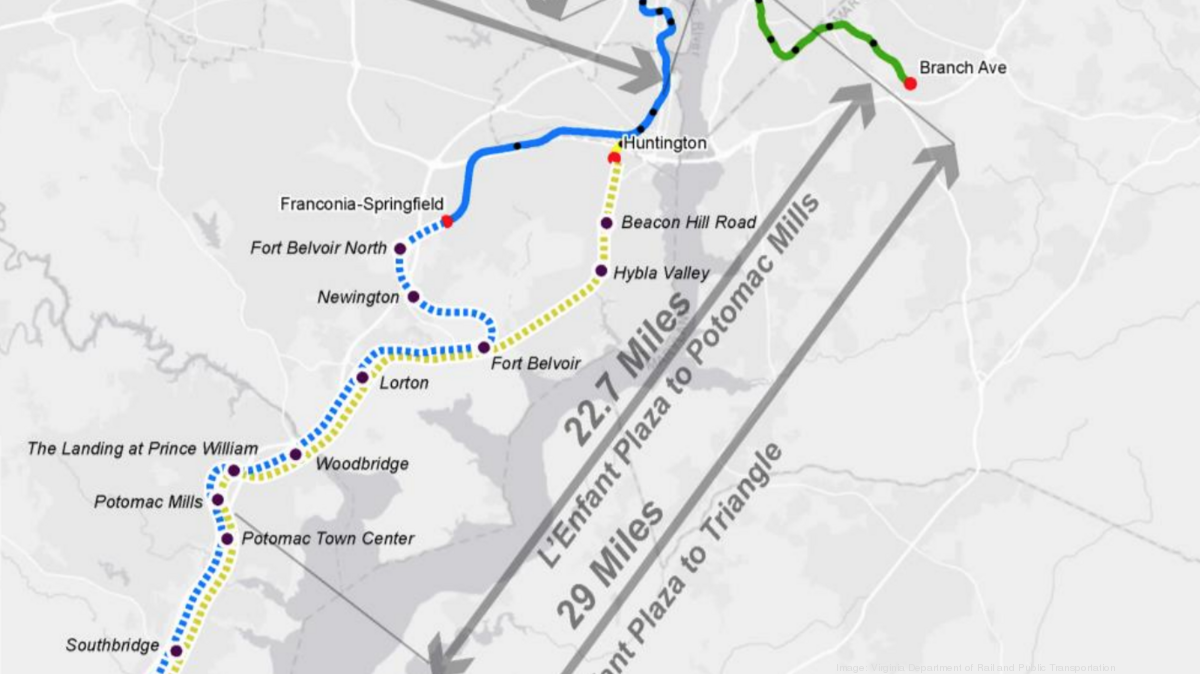

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Facility Event Rental The Prince William County Fair

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

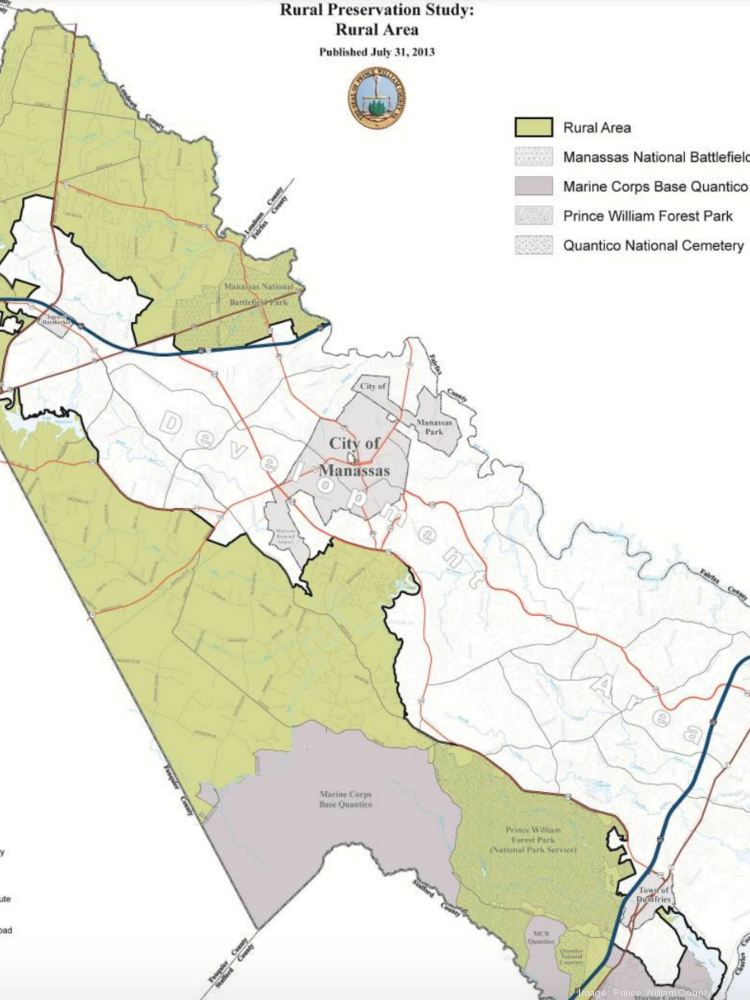

Data Center Opportunity Zone Overlay District Comprehensive Review

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

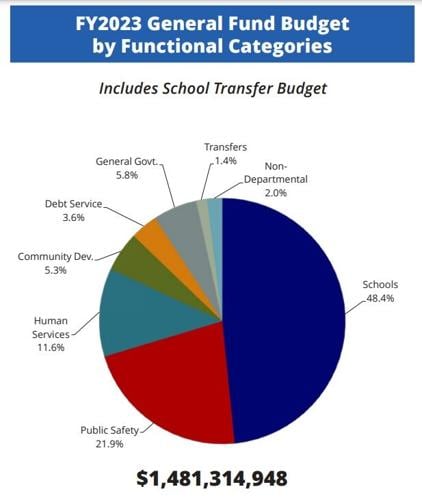

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living

Welcome Back Prince William County Police Department Facebook

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Class Specifications Sorted By Classtitle Ascending Prince William County

New Public Crime Prince William County Police Department Facebook

Prince William Wants To Hike Property Taxes Introduces Meals Tax

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Prince William County Park Rangers New On Call Number Effective April 1 2022